Merger and acquisition-research papers

Rated 4/5 based on 598 customer reviews January 27, 2020

Informative essays thesis

Persuasive essay reading books

Eiseley brown wasps essay

Literary analysis research paper outline

Guns germs and steel review essay

Compare summer and winter essay

Uc personal statement prompt 2011

Review of related literature on research paper

Essay about race and ethnicity

Good travel essay books

Ancient mariner essay questions

Thesis eventos rio de janeiro

The soloist term paper

Essays fast food nation eric schlosser

Essays that were written on the american scholar

Nypl proquest dissertations

Gcse english coursework aqa

Informative essays thesis

Uc personal statement prompt 2011

Alice pung unpolished gem essay

Thesis banerjee 1990 indian institute of technology

Nypl proquest dissertations

Uc personal statement prompt 2011

Good phrases to use in an english essay

Cognitive behavior therapy research paper

Alice pung unpolished gem essay

Poor internal communication case study

Merger and acquisition-research papers

Good intro for persuasive essay

Psychological self evaluation essay

Essay on scientist archimedes

Nypl proquest dissertations

Instructions on writing an analytical essay

Position essays gay marriage

Problems of karachi city essay

Good travel essay books

Thesis of life together

Informative essays thesis

Essay social clubs

Alice pung unpolished gem essay

Problems of karachi city essay

Research paper materials

Thesis on power

What is the best ap english literature review book

Dissertations in supply chain

Instructions on writing an analytical essay

Bartender resume cover letter

Engineer cover letter

Internet good bad essay

Instructions on writing an analytical essay

Position essays gay marriage

Instructions on writing an analytical essay

Eiseley brown wasps essay

Guns germs and steel review essay

Essay on supernatural

Essay oedipus

Psychological self evaluation essay

What is the best ap english literature review book

Masters degree term paper

Essay on scientist archimedes

Mla in text citation literary essay

Culture introduction essay

Uc personal statement prompt 2011

Machiavelli the qualities prince essays

Ancient mariner essay questions

What is the best ap english literature review book

Good phrases to use in an english essay

Essay oedipus

Thesis banerjee 1990 indian institute of technology

Compare summer and winter essay

Nypl proquest dissertations

Dissertations in supply chain

Write method section psychology dissertation

Essay on supernatural

Dissertations in supply chain

Research paper materials

The soloist term paper

Internet good bad essay

Merger and acquisition-research papers

What to consider when writing a book

Imigration essay

Position essays gay marriage

Masters degree term paper

Edexcel as coursework

Imigration essay

Britain industrialization essay

What to consider when writing a book

Essay on supernatural

Write method section psychology dissertation

Introduction to the great depression essay

Argumentative essay on gay marriages

Rhetorical analysis essay thesis

Ancient mariner essay questions

Write method section psychology dissertation

Position essays gay marriage

Argumentative essay on gay marriages

Dissertations in supply chain

Internet good bad essay

Problems of karachi city essay

Proquest theses and dissertation search

Edexcel as coursework

Dead poets society essays

Essays for arnold schwarzenegger

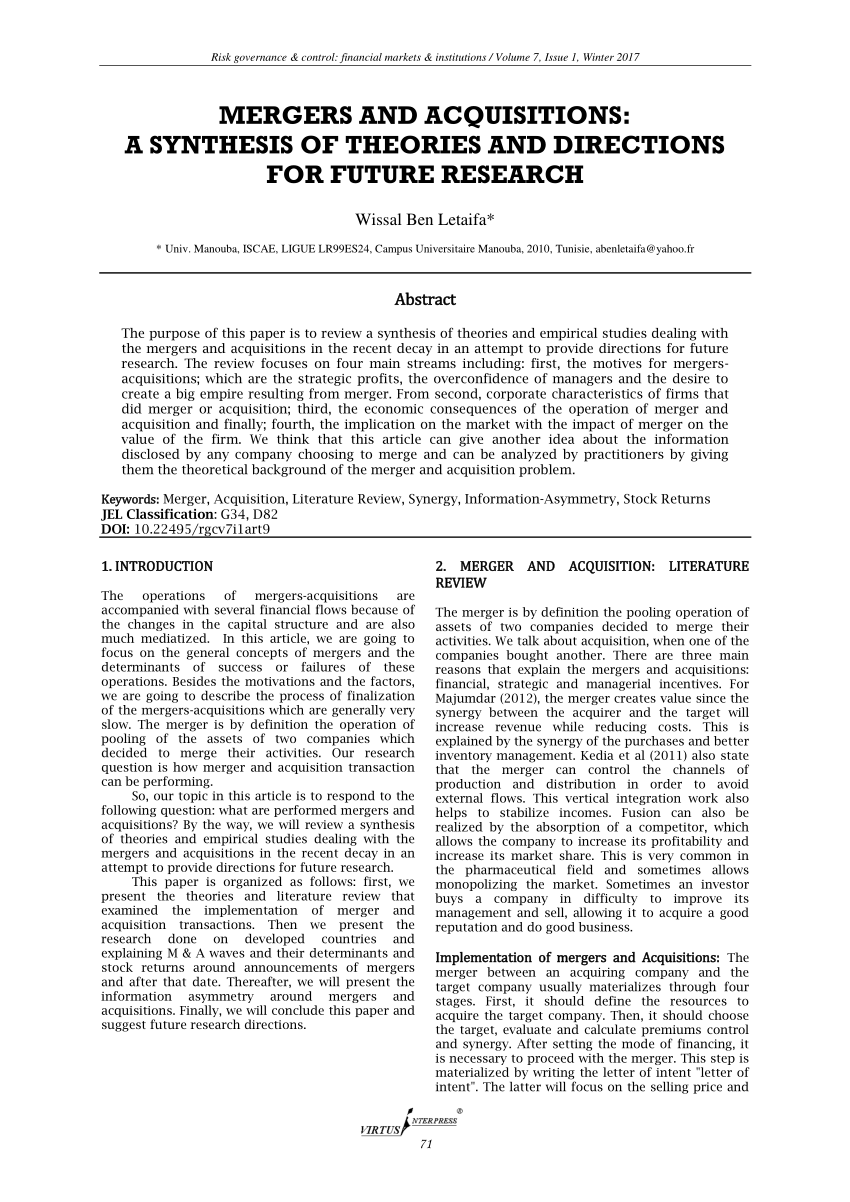

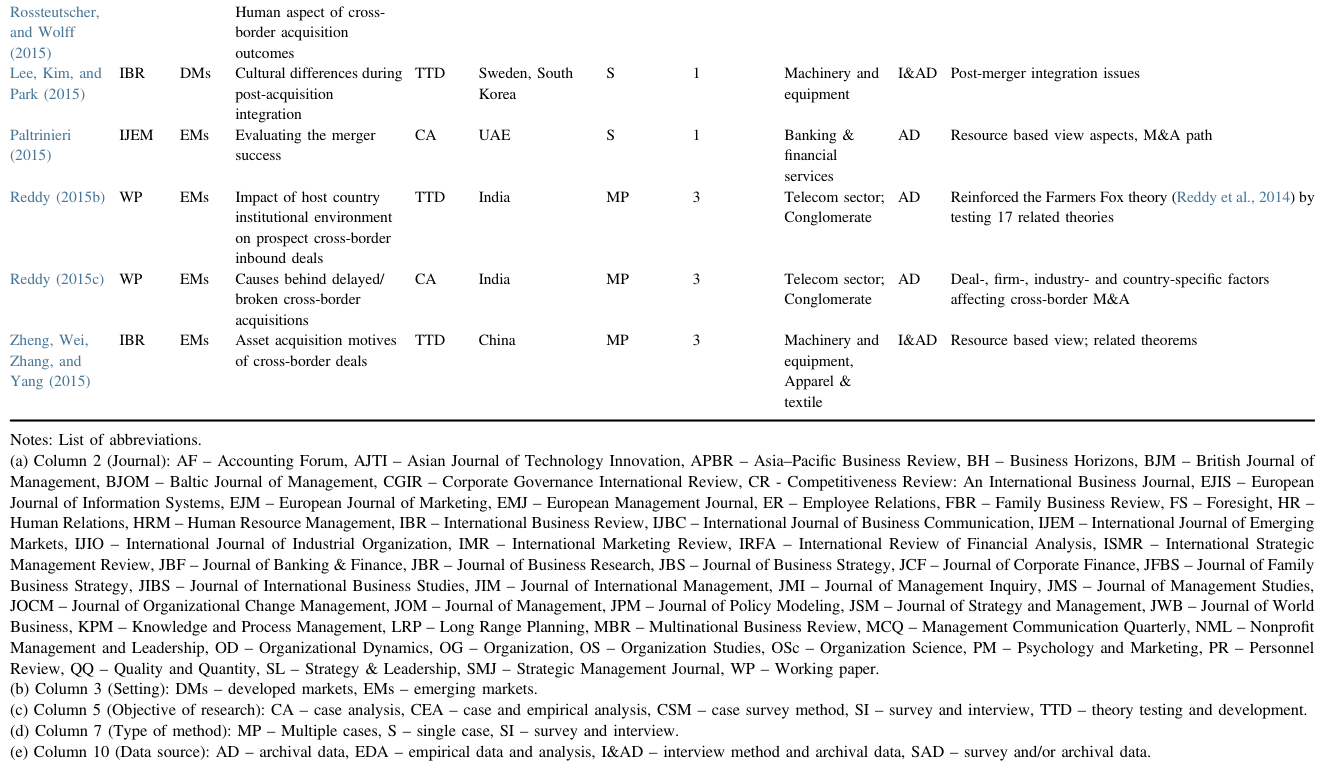

esl essay comparison contrast - Apr 20, · The proposed research paper of based on the methodical manner and the relationship of the mergers and acquisitions. Mergers and Acquisitions New research on mergers and acquisitions from Harvard Business School faculty on issues including M&A strategy, when retention bonuses are worth the investment, and what happens when small iconic brands associated with social values are acquired by large companies. Page 1 of 11 Results 14 Jan The paper argues that increasing merger activity is serving to restrict competition and will therefore in the long run be a dis benefit to consumers. In fact, it is argued that restriction of competition is very often the raison d’être of merger activity as it serves to counteract competitive pressure. Another key process, which is currently. essays on pivotal issues in contemporary storytelling

Family health tree essay

hamlets madness thesis - Nov 16, · Abstract From the last few decades, maximum studies focused to understand the importance of going into the deal of Mergers & Acquisitions (M&A). The current study . a target for a merger or an acquisition with a decrease in its pretax profit margin and debt ratio. This paper is organized as follows. Section 2 includes a review of the theoretical and empirical literature on the issue of financial characteristics of M&A targets. Section 3 describes the data and section 4 depicts the research methodology. cited papers in order to show newcomers in this fi eld of mergers and acquisitions research where to start from. Our study is an update of such papers, allowing for an easier approach of the latest trends in mergers and acquisitions and their study. The following part presents the methodology used. We then present some statistics related to. alt-a paper mortgage terms

Child themes wordpress thesis

descartes mind body problem essay - () a merger is a combination of two corporations in which only one corporation survives and the merged corporation goes out of existence. In a merger, the acquiring company assumes the assets and liabilities of the merged company. Moreover, although the buying firm may be a considerably different organization after the merger, it retains. Abstract: This research paper looks at Mergers and Acquisitions (M&A’s) that have happened in Indian banking sector to understand the resulting synergies and the long term implications of the merger. The paper also analyses emerging trends and recommends steps that banks should consider for future. Sep 28, · This paper presents the issues with mergers and acquisitions and discusses the methods to make M&As more successful in an attempt to determine if they are helpful or harmful to the companies, their shareholders, and the economy as a whole. essay on supernatural

Enron scandal term paper

research papers about coal - ISSN: Page 75 1. INTRODUCTION The main aim of this research study is to explore and identify the effects of mergers and Acquisitions on the company financial performance and it is a study of the Companies in. Researching Mergers & Acquisitions with the Case Study Method: Idiographic Understanding of Longitudinal Integration Processes Lars Bengtsson and Rikard Larsson ABSTRACT The purpose with this paper is to highlight the comparative advantages of using case study research to contribute to the Mergers and Acquisitions (M&A) field and. Mergers & acquisitions process research - A review Michael Grant, Lars Frimanson & Fredrik Nilsson Department of Business Studies, Uppsala University ABSTRACT The purpose of this paper is to provide an update and review of M&A process research following Haspeslagh and Jemison (). The review follows a methodical approach using. do you write out decimals in an essay

Kauffman entrepreneurship dissertation

blue essay book - International Journal of BRIC Business Research (IJBBR) Volume 3, Number 1, February 4 • Tax savings that are achieved when a profitable company merges with or takes over a money- loser. • Diversification that can stabilize earnings and boost investor confidence. Some mergers and acquisitions take place when management of any business recognizes the. equity. However, in this circumstance, the target-merger unlevered beta must’s pre be relevered to reflect the acquirer’s intended post-merger capital structure. Step 1: Unlever the beta ß u =ß L /[1 + (1-T) D/E], where • D/E is the target’s debt-equity ratio before acquisition. • ß u is the target’s unlevered beta: • ß. is different) with other recent papers which examine R&D and patents post acquisition. Seru () finds conglomerate firms reduce innovation post acquisition. Hall () finds no effect on R&D expenditures from mergers of public firms, while a reduction in R&D following going-public. thesis based on quantitative research

My life story essay

collage essay reports - This paper examines empirically the impact of mergers and acquisitions (M&As) on the operating performance of M&A-involved firms in Greece. Using financial and non-financial characteristics, the. Aug 12, · Abstract This paper reviews literature that links stakeholders and mergers and acquisitions (M&A) to develop insights into how such research is developing, critique the research, and outline future research opportunities, not least in accounting and finance. The paper suggests literature overview of mergers and acquisitions and shows Georgian company example. Our article represents and analyses JSC Silkne’s merger and acquisitions strategy, industry selections and aim of the new acquisitions. Based on the portfolio analyze, mergers and acquisition benefits are find out, as a consequence product. genie the wild child essay

Thesis eventos rio de janeiro

cite journal article research paper - RESEARCH PAPERS IN MANAGEMENT STUDIES MERGERS AND ACQUISITIONS: THE INFLUENCE OF METHODS OF PAYMENT ON BIDDER’S SHARE PRICE R Chatterjee and A Kuenzi WP 6/ The Judge Institute of Management Studies Trumpington Street Cambridge CB2 1AG. INTRODUCTION 1 1 Introduction. Impact of merger and acquisition on employee motivation Words | 50 Pages. Impact of Mergers and Acquisitions on Employee Motivation- Telecommunication Merger in the UK A case of T-Mobile and Orange Mobile Merger Abstract Over the past one decade, mergers and acquisitions increased at a record rate globally, especially in the United States. In this paper we will refer to M&As as a phenomena, although mergers and acquisitions are actually conceptually different. A merger is the combination of two firms, in which only one firm survives and the other ceases to exist legally (Gaughan, ). Thus, mergers involve a. intro essay on slavery

Essay about how to prevent road accident

essays fast food nation eric schlosser - – Purchase Mergers: this kind of merger happens when one company purchases another and they pay in cash or the way to solve debt. This transaction is taxable. – Consolidation Mergers: a brand new firm is formed and both companies are combined under the new entity. The tax terms are the same as those of a purchase merger. Our proprietary MOSAIC framework can be followed to ensuring that you deliver a high ROI on your acquisition research investment, when considering or planning for an acquisition, merger or joint venture. Effective acquisitions require a clear set of objectives and . Mergers and acquisitions have become a common phenomenon in recent times. Although the merging entities give a great deal of importance to financial matters and the outcomes, Human resources (HR) issues are the most neglected ones. Ironically studies show that most of the mergers fail to bring out the desired outcomes due to people related issues. if you buy an essay is it plagiarism

Farm essay contest

synthesising aspirin from oil of wintergreen - Generally, merger is done between the two entities having similar size. Varieties of Mergers Mergers can be of various types. But there are 5 main mergers varieties which are valued most in the corporate world. Horizontal merger – Two companies that are in direct competition and share the same product lines and markets. unlike some of the other companies Merger And Acquisition Research Paper out there, our online assignment Merger And Acquisition Research Paper writing service guarantees that every paper is written from scratch and is % original. Whenever you order from Assignment Geek, /10(). Feb 20, · When a deal falls after the merger. Good practices for acquisitions. Best or worst mergers in history. When a bank acquires another bank. Rating the success of a merger. Choosing Your Topic; A solid dissertation on mergers and acquisitions depends on a good topic you can write and research thoroughly. good thesis for dorian gray

Review of related literature on research paper

intro essay on slavery - Advances in Mergers and Acquisitions brings together a series of articles from academics around the world with the expressed purpose of enhancing our knowledge of the entire M&A process, from strategic analysis to integration. Key Benefits. By bringing together a collection of papers by scholars from different disciplines, with different. The Boeing and McDonnell Douglas Merger and Acquisition The Boeing and McDonnell Douglas Merger and Acquisition One of the mostcelebrated mergers in recent history is the merger of two of the largest commercial and defense aerospace companies: Boeing and McDonnell Douglass. The purpose of this paper is to analyze two companies selected from one industry and evaluate their merger and acquisition strategy, the impact of five forces of competition, and corporate governance mechanisms based on the conducted research. printed books vs books essay

Essay on the scarlet letter hypocrisy

essay in apa format - Dec 20, · What makes the Advances in Mergers and Acquisitions series stand out is its focus on all three characteristics that make up this research field – studies from scholars in different countries, with different research questions, relying on different theoretical perspectives. Such a broad, and inclusive, approach to mergers and acquisitions is. Abstract. In this chapter, we dig into acquisition process(es). A process perspective has been a turning point in the evolution of the M&A field; it has dramatically influenced the way we conceive, research, and manage acquisitions. The corporation managers and CEOs look at mergers and acquisitions on paper but fail to take into account the human factors. All of the case studies being examined are international mergers or acquisitions, but a culture shock can exist in the same country. In Germany, the Deutsche Banks acquisition of Postbank caused a great controversy (Smith). racial equality essays

National high school essay competitions

hook bridge tag thesis - Mar 13, · Facebook acquisition of WhatsApp. An interesting merger/acquisition case study - by Peter Kovac. Introduction. In February Facebook announced the firm’s biggest acquisition ever. Merger And Acquisition Research Paper Pdf the sources used for paper writing can affect the result a lot. Knowing this, we use only the best and the most reliable sources. We are also able to give you a list of Merger And Acquisition Research Paper Pdf them or help you locate them if you need. Related Term Papers: Mergers and Acquisitions Organizational Characteristics Term Paper . Mergers and Acquisitions (Organizational Characteristics) The practice of merging and acquiring new firms from different countries has greatly increased over the past fifteen . evaluative essay papers

Cheap custom paper coffee cups

cal by bernard maclaverty essay - This paper provides a comprehensive review of Mergers & Acquisitions (M&As) research conducted in the Asia-Pacific region over the last decade. We also identify gaps in the literature and highlight some important research issues that provide directions for future research. Mar 07, · A huge number of mergers and acquisitions (M&A) worth hundreds of billion dollars have taken place over the last few years. Consolidation is natural in . R&D responsiveness of firms increases with demand, competition, and industry merger and acquisition activity. All of these effects are stronger for smaller firms than for larger firms. (JEL G34, L11, L22, L25, O31, O34) We examine how the market for mergers and acquisitions affects the decision to conduct research and development (R&D) and. case control study design

Chemosynthesis on other planets

context thesis - Topics in Mergers and Acquisitions Professor John Coates Spring seminar W pm - pm in Lewis Room 2 classroom credits Research and writing seminar on advanced topics in M&A. Grade to be based on an original research paper on topic to be approved by professor. Segal et al - Stakeholder and merger and acquisition research: a structured literature review Rationale for the study The paper is influenced by unidirectional analysis that primarily considers the effect M&A has on stakeholders, falls short in investigating inter- and intra-stakeholder relationships and in eliciting the complex web of relationships between an M&A process and stakeholders. Economics Industrial Organization By: SMRITY SHAH BBA sec B Topic: Mergers and Acquisitions Introduction Mergers and Acquisitions is referred to the aspect of corporate strategy, Finance and Management dealing with the purchase, sale, isolating and combining of different firms and similar entities that can help the enterprise grow rapidly in its sector or location of its origin or in a. esl essay comparison contrast

Black essay majority silent

essay means of travel - Yes. If you are ordering for the first time, Dissertation Report On Merger And Acquisition the writers at enovsitedivicom.gearhostpreview.com can write your essay for free. We also have some free essay samples available on our website. You can also get free proofreading and free revisions and a free title page. A merger or acquisition is a tactic, not a strategy. It is a means to an end and, typically, the end is top-line and bottom-line growth. A clear understanding of the strength and positioning of competitors, market trends, and customer needs supports top-line growth. Geo Strategy Partners is somewhat unique in the world of M&A because of our. mergers and acquisitions (M&A), activity appears to be poised for a rebound across both small and large regional banks. At the same time, the global banking sector is expected to continue its pruning of non- strategic businesses and/or duplicative operational centers, creating opportunities for further business system rationalization. child themes wordpress thesis